With the day-by-day shift of focus to online transactions, it becomes imperative for firms to understand the differences between fee aggregators and fee gateways, which are crucial for constructing environment-friendly payment processing services. Both are involved in the presentation of electronic bills; however, they operate differently and have different tasks. Here, the differences between a Zupain, payment aggregator and a payment gateway shall be discussed.

Payment Aggregator:

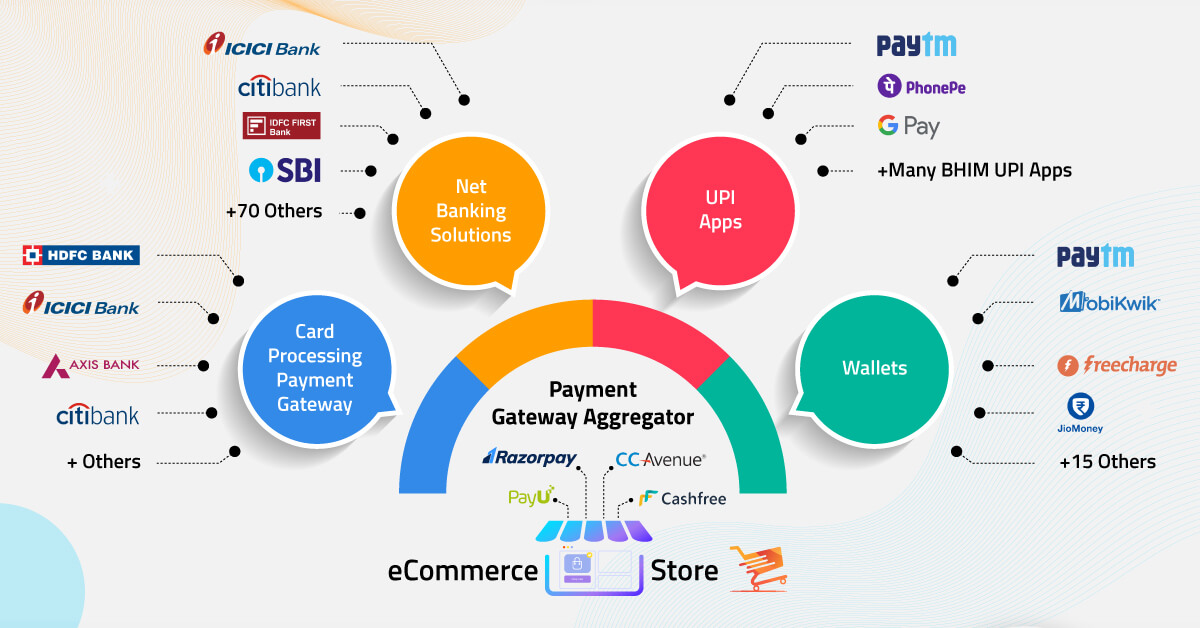

A payment aggregator, together with Zupain, facilitates the charging procedure since the system permits traders to accept a couple of charge options through an unmarried platform without having to integrate with the service provider account with the financial institution. Zupain is a middleman that consolidates disparate payment services; they accept credit cards, debit playing cards, virtual wallets, and bank transfers as a form of payment.

The essential blessings of using a payment aggregator

- Ease of Setup:

Another peculiarity of payment aggregator is that the initiation of payment aggregator services generally requires less time and paperwork than in the case of the gateways’ services. At least, the merchants can begin to accept bills the mimesis minute after the registration.

- Cost-Effective:

Some of the reasons why these aggregators are preferred include the high value from the low aspect of setting payments, low transaction cost, and attractiveness to SMEs.

- Simplified Integration:

It offers various basic integration alternatives with several e-trade platforms, reducing merchants’ technical concerns.

- Wide Range of Payment Options:

Numerous charge services get assistance from aggregators, thereby enhancing the probability of transaction climax through patron choices.

Payment Gateway:

A payment gateway can be described as a provider that both approves and processes the costs of on-the-web and offline transactions. He serves as the link between a merchant’s internet site and the monetary establishments that are part of the financial exchange to ensure the secure transmission of payment records. Regular payment gateways always need the merchants to have their own personal service provider’s credits.

Key capabilities

- Control and Customization:

Business people have extra regulation over the fee system and may likely adapt their payment solutions to meet the calls for of the business.

- Security:

Through these payment gateways, enhanced security features, along with encryption and other online fraud detection mechanisms, make transactions more secure and sound.

- Scalability:

These are ideal for businesses that have a large volume of transactions and those that require robust and scalable payment options.

- Direct Relationship with Banks:

In particular, merchants often employ a direct fee gateway that has high fees and supports their acquiring banks.

Comparison:

Despite the fact that each payment aggregator and charge gateway support online invoices, the preference between them depends on the exact needs of the business. Platforms similar to Zupain are first-class and appropriate for small to medium-sized organizations that want to integrate a cost-effective, easy-to-implement answer that supports lots of fee strategies. On the other hand, a fee gateway is suitable for large organizations since they require more control, integration and direct links to the banks.

In conclusion, Zupain, as a payment aggregator, offers an inconvenience-loose, reasonably-payment answer with massive value strategy help; thus, it’s a perfect solution for SMEs. Subsequently, conventional payment gateways deliver more control, security and flexibility to satisfy the demands of a number of giant companies. Businesses should compare their volume of transactions, technical competencies, and particular requirements in order to arrive at an informed decision between the two.